|

| |

Copyright © 2024, Michael D. Jenkins, Esq. and Ronin Software

All Rights Reserved

SPECULATOR: THE STOCK TRADING SIMULATION -- UPDATE INFORMATION

|

THE "SPECULATOR" -- NEWS OF LATEST RELEASE (Version 4.11)

- YouTube Videos of Speculator Now Available: A fan of

Speculator in the U.K. has created a whole series of videos on

YouTube, where he plays Speculator and explains what he is doing,

in a very interesting fashion. While Speculator is a Windows

program, he runs it on a Mac, within a Windows emulation program

called CrossOver, apparently. While it does work pretty well on

the Mac, the emulation program doesn't translate some of the

fonts that well to the Mac iOS, so the stock ticker and some other

parts of the program look a bit weird, unlike when it is run on

a native Windows system, but it still works OK. He has posted a

series of videos, each about 20 minutes in length, though there

was an audio problem with his first two episodes, making it a bit

difficult to understand everything he was saying, but the audio is

fine in the subsequent episodes. Check it out! It is informative

and entertaining to see how he does his investment research,

although he barely scratches the surface in terms of the number

of research tools he utilizes.

Click HERE for YouTube Link!

- Version 4.10 and 4.11 -- Released August 14, 2023 and April 14, 2024 -- Possible Final Release:

- Version 4.11 Free Upgrade for Purchasers of v. 4.10.

The only changes in 4.11 from 4.10 are, per user suggestions:

The company names listed on the Streaming Stock Quotes List are now

clickable -- just click on any company name on the list and it instantly

becomes the Selected Entity whose information is displayed in the various

menus, or on which you can trade in its put or call options; and

... if you select the large single screen version from the Game Options

Menu before starting a new or saved game, the large single screen

will become the default version that is displayed next time you

load Speculator. But you can change the default back to the small,

multi-screen version from the Game Options Menu on the large screen

version, if you wish.

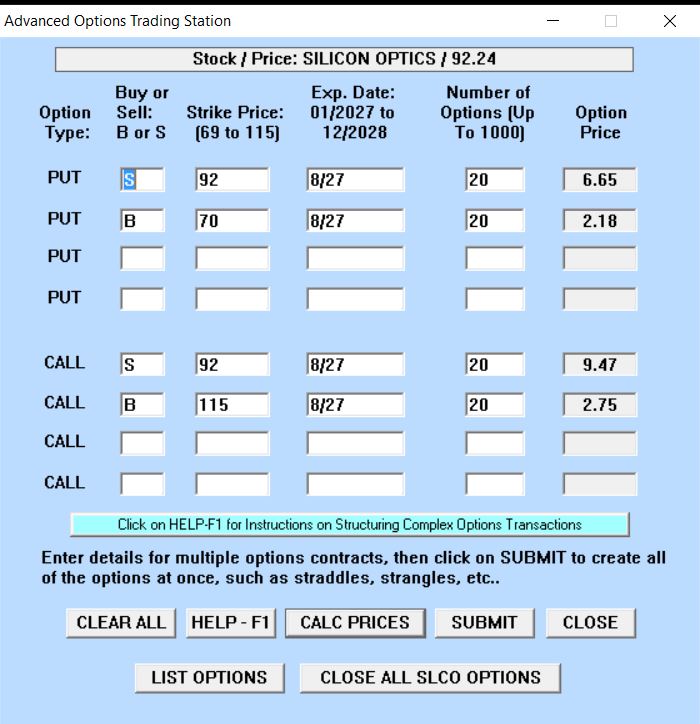

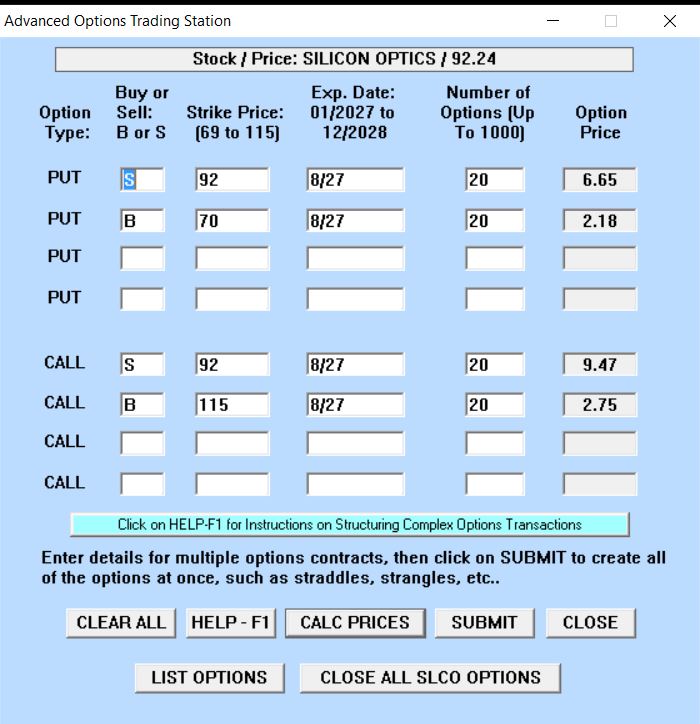

- Automated Options Trading Added for Complex Options Trades.

In Version 4.0, we released an Advanced Options Trading Station

to enable players to create complex options strategies involving

multiple puts and/or calls at various strike prices, which trades

the program will execute all at once. We also provided extensive

HELP file information on how to construct most of the main options

strategies used by professional traders, such as straddles,

strangles, vertical bull or bear put or call spreads, Condors,

Butterfly spreads, Iron Condors and Iron Butterflies. However,

we realize that these are all rather difficult strategies for

amateur investors to comprehend or try to implement, even with

the improved tools for doing so and detailed guidance.

Thus, in Version 4.10 and 4.11 we have added a feature that

automatically creates any of 14 of the most popular complex

options trading strategies, so that all you have to do in

this new version is click on the AUTO-TRADE button on the

Advanced Options Trading Station screen, and select one

of the strategies from the menu that pops up, shown below:

The new automated complex options trading feature is the

only significant change in this release, from versions

4.0-4.02.

- Minor Bug Fixes in DataBase Search Features:

In the Version 4.0-4.02 releases, if you did database searches

for companies that have positive cash flow, the algorithm would

exclude banks, since cash flow projections for banks are largely

irrelevant. However, another feature we added a while back, to

limit your searches to a single industry, conflicted with that

search logic. Thus, if you did a search that was limited to

the banking industry and one of your criteria was to look for

companies with cash flow, the result would always be zero

stocks that met all your search criteria. Thus, in this

version, if you limit a search to the banking industry

and also select the "positive cash flow" criterion, the

program will uncheck the cash flow item on the Database

Search screen and will ignore that factor in searching

for banks that meet all your other search criteria.

- Our Final Release of Speculator? This

may well be our final release in the development of

Speculator, and Wall Street Raider may also be near the

end of development, unless a current project to upgrade

the user interface (GUI) is successful.

It has been a fun run, constantly tinkering with and

improving Wall Street Raider since 1986 and Speculator

since 2016, and matching wits with smart users who always

seem to be able to find "loopholes" in the simulations

faster than I can plug them, but I'm coming up on age

80, and have put all the useful features I can think of

into Speculator. All good things must end, eventually.

- Currency Exchange Rates Updated. In

the current global economic climate, exchange rates have

been changing rapidly in the last year, thanks to wars,

sanctions, and other factors. Thus, we have updated the

default exchange rates for the 18 non-US currencies for

which Speculator can be configured, as of the summer of

2023. (Remember, when starting a new game configured in

a non-U.S. currency, Speculator lets you change the

exchange rate for that currency, if you wish to do so,

instead of using the built-in default rate.)

- Compatibility With Earlier Versions.

Version 4.11 is compatible with game data files saved by

all earlier releases of Speculator.

- Version 4.0 -- Released October 1, 2022:

- Advanced Options Trading Platform Added.

We recently received an excellent suggestion by a user of

Speculator, requesting that we create an options trading

platform for doing complex options trades all at once, something

similar to the real-world Trade Station offering by Ameritrade.

Until now, it was possible to construct sophisticated options

trading strategies (hedges) in Speculator, such as straddles,

strangles, bull spreads, calendar spreads, Butterfly spreads,

etc., but you had to know how, and had to put the different

options positions in place one trade at a time, so that often,

between putting in the trades, the price of the underlying

stock would have moved significantly, making it difficult to

implement the complex position as you had intended.

Thus, we have added a full screen "Advanced Options Trading

Station" to this release of Speculator, letting you do up to

4 put trades (of a large number of options per trade) and 4

call trades, all at one time. Also, one click on a "Close

All SLCO Options" button allows you to instantly close all

option positions on a particular stock, such as SLCO (stock

symbol), in the example on the image below.

In addition, the HELP button on this "trading station" screen

will take you directly to a detailed discussion, with examples,

of all the major options trading strategies -- covered calls,

long or short straddles or strangles, vertical bull or bear

spreads, calendar spreads, Butterfly (and reverse Butterfly),

Condor and reverse Condor spreads, and Iron Butterfly or Iron

Condor spreads. You can learn a lot, by trial and error, about

complex options trading strategies used by professional options

traders with this new tool and the accompanying, very detailed

strategy explanations and instructions.

Commodity and Other Price Alerts Are Now Available.

In Version 2.0, we added stock price alerts to Speculator.

In response to requests of users who found the stock price

alerts very useful, aiding them in trading and investing,

this release has added price alerts on spot prices of the

five commodities in the simulation -- oil, gold, silver,

wheat, and corn, as well as on the Bitcoin and Ethereum

cryptocurrencies, and the Stock Index.

Interest and Other Rate Alerts Are Now Also Available.

In addition to the addition of price alerts on commodities,

cryptocurrencies, and the Stock Index, this release allows

you to set up alerts to notify you when any of the interest

rates (prime rate, long bond rate, and short bond rate)

reach a level you specify, or when the GDP growth rate goes

to, above, or below a growth rate you specify.

Because of the many, constantly changing economic and financial

factors in the game, as game time passes, it is often easy for

you to fail to notice some major change that is occurring, such

as a large increase or decrease in interest rates, or an

emerging economic boom or recession or spike in a commodity

price. Accordingly, you can now set up alerts for any of the key

economic and financial indicators, so you will be alerted when

one falls to or rises above levels you specify, which can be

very helpful in reminding you to review and perhaps change your

current investment strategy.

Up to 100 stock and/or commodity price or rate alerts can be

pending at any one time. As with stock price alerts, each

commodity price or other alert will remain in effect for a

full year of game play, or until the price or rate objective

has been reached and you have been notified by an announcement,

whichever occurs first. You can set up alerts at multiple

price points or rate levels on a particular item and on one

or more stocks.

Now, instead of a "Set Stock Alert" button on the MISC Menu,

on the small-screen version of Speculator (or setting, on the

Settings pull-down menu on the large-screen version), that

button (or setting) has been replaced by a "Set Price or Rate

Alert" button or setting. Clicking on it brings up an extensive

menu from which you can pick the type of alert you want, either

a stock price alert on the current "Selected Entity" or an

alert on one of the various commodities or other items for

which alerts are now available.

New Database Search Features, To Find Companies with

Positive Cash Flow. Two new cash flow-related items have

been added on the Database Search screen. One allows you to

search for companies with projected positive cash flow for

the next 3 months. The other allows you to also include in

your search results those companies that have negative cash

flow overall, but that have positive cash flow before debt

repayments on their line of credit and/or the payoff of a

maturing bond issue.

New Database Search Features, To Find Short Sale Candidates.

Two more database search features have been added, in order

to search for possible short sale candidates. Select the "FIND

SHORT SALE CANDIDATES" item on the Database Search screen and

the program will look for stocks that have a number of negative

characteristics, such as downward momentum, excessive price-to-

net worth ratios, and negative cash flow, and will list such

stocks.

Since many of the stocks that will be listed will be those that

are D-rated (bankrupt, but not yet liquidated or reorganized),

and since the simulation will only allow you to short 100 shares

of such stocks, a second button, "...BUT EXCLUDE BANKRUPTS," has

also been added, which will exclude any such "walking dead"

companies in the selection process, if you also check that box.

Thus, if you check that box to exclude the "zombie" companies,

the only short sale candidates that will be listed will be those

companies with "C" or better credit ratings, which you can sell

short in large quantities, limited only by your net worth and

(in rare cases) by the amount of the publicly traded share

"float" for that company's stock.

Limits on Size of Options Trades. As some players

have pointed out, it was possible to do enormous options trades,

which enabled them to make billions of dollars quickly, with the

size of trades limited only by their net worth and, if selling

options short, by margin requirements. In the real world, it is

often difficult or impossible to trade more than a few options

on stocks of some small companies, where there is not a lot of

liquidity in the stock. Accordingly, this version of Speculator

places some (variable) limits on the number of option contracts

you can create in a single transaction, and the limit is loosely

correlated with the market cap of the underlying stock.

Currency Exchange Rates Updated. In the

current global economic climate, exchange rates have been

changing rapidly, as the strong U.S. dollar has increased

in value against nearly all other major currencies, except

the Russian Ruble. We have updated the exchange rates for the

18 non-US currencies for which Speculator can be configured,

as of late September, 2022.

Compatibility With Earlier Versions.

Version 4.0 is compatible with game data files saved by

all earlier releases of Speculator.

Versions 3.01 and 3.02 -- Released December 5 and 26, 2021 (Minor bug fixes):

- Bug Fixes.

These updates fix a rare bug that could occasionally cause

an error when displaying an earnings report for some highly

leveraged banks, preventing the earnings report from being

shown. They also fix a bug that sometimes allowed a crypto

currency ETF to buy stock and retain it, neither of which

actions should have been allowed.

This is a free upgrade for anyone who bought Version 3.0,

upon request to Ronin Software.

- Compatibility With Earlier Versions.

Version 3.02 is compatible with game data files saved by

all earlier releases of Speculator.

Version 3.0 -- Released October 1, 2021 (Major upgrade):

- Inflation Hedges Now Available in the Simulation.

It's a sign of the times....Inflation has come to Speculator!

(No, not to the price of the software, which hasn't changed

since its initial release in 2016.) In the simulation, inflation

is not all bad; this release adds an inflation factor to

the prices of gold and silver, which will tend to gradually

appreciate, all other things being equal, at about 4% a year

above an assumed initial price of $1,200 per Troy ounce. Thus,

buying and holding long-term (5-year) futures will tend to be

more profitable for gold and silver investors, since their

prices will now have an inflationary bias. This will tend to

make precious metals futures somewhat of an inflation hedge,

though not necessarily a great investment, unless your timing

is very good.

- Bitcoin and Ethereum Cryptocurrencies Added to the Sim.

Keeping up with the changing real financial world, Bitcoin has

been added as a new asset class in Speculator, and we have

also added Ethereum, another popular crypto-currency. As in

the real world, we have made the price action in both cryptos

EXTREMELY volatile, as pure speculations, and both also include

an inflationary bias, as with the precious metals. Thus, both

of the cryptos are also somewhat of an inflation hedge, if you

are not wiped out by the extreme price fluctuations in the

interim!

However, since the price of a single Bitcoin in the simulation

will often exceed the $100,000 you start the game with, it would

be difficult to buy even a single Bitcoin at times. Thus, you

won't trade the cryptocurrencies directly; instead, we have

introduced two new ETFs, Bitcoin Trust and the Ethereum Trust,

each of which invests exclusively in one of the two cryptos,

except for a small allocation (under 10% of assets) to cash. It

will be easy to buy the shares of the ETF.

The ETFs will be over 90% invested in cryptocurrenciess and

therefore, accordingly, the price action of the ETF shares will

almost exactly track the crazy volatility of the underlying

Bitcoin or Ethereum. So you will be able to speculate in these

two cryptocurrencies by buying shares in the ETFs. The only

significant difference from buying the cryptos directly is

that, if you qualify for options trading, you will also be able

to buy or sell put and call options on the stocks of the crypto

ETFs, and you may occasionally receive a small dividend from the

ETFs if you buy the ETF shares, as both of the crypto ETFs pay

a minimum 1% annual dividend, even if it exceeds their interest

income.

We have also added a new (but rare) scenario, where Bitcoin

may be banned by most of the world's major nations. While it

will not be completely eliminated if that occurs, as it will

still be legal in a few countries like Belarus or Bangladesh,

its price will take an enormous plunge of 90% or more and won't

ever significantly recover from the banning during the rest of

the game. This danger adds another element of risk to your

trading in Bitcoin ETFs, which are already wildly volatile in

this simulation, as are the cryptos in the real world, where

China is already threatening a real-world ban of Bitcoin.

- New Way To Sort List of Bonds in DataBase Search:

A useful improvement to the DataBase Search routine, for

bond searches, now sorts the display of the bonds that meet

your search criteria by the maturity date of the bonds.

This will make it easier, for example, to find bonds that

mature very soon, which can be a good place to park excess

cash at a reasonable interest rate. However, if you check

the "Credit Rating" button to only display bonds with a

specified minimum credit rating, then the bonds will be

sorted by credit rating, as in prior versions of the game.

- Refinement To Individual Cash Flow Projection:

An additional adjustment to the cash flow projection for a

player has been made, where the player owes a margin loan,

if the "Auto-Sweep" setting is turned on to automatically

apply cash to reduce any such loan balance. Thus, if the

player might otherwise have $50,000 of cash a year in the

future, but owes a $20,000 margin loan, which will be paid

off as the cash comes in (if Auto-Sweep is turned on), a new

line item is added to show the loan repayment, so the ending

cash projection in this example would be reduced to $30,000.

No such adjustment is shown if Auto-Sweep is turned off.

- List Options Button Added: In the small screen

(multi-screen) version of the simulation, a "List Options"

button has been added to the Options Trading Desk screen,

so you no longer have to go back to the My Fin. Info Menu

to view a list of your options positions, while you are

trading options. By clicking on an options position on a

stock other than the current Selected Company, you can

quickly choose a different company on which you may buy

or sell options, which then becomes the Selected Company,

for purposes of further transactions or research.

- List My Bonds Button Added: In both the small

screen (multi-screen) and large screen (single-screen)

versions of the simulation, a "List My Bonds" button has

been added to the Bond Trading Desk screen, so you no

longer have to go back to the My Fin. Info Menu to view

the list of your bond holdings, while you are trading

bonds. By clicking on a corporate bond holding on your

list of holdings for a bond issuer other than the current

Selected Company, you can quickly choose a different

company whose bonds you may buy or sell, which company

then becomes the Selected Company, for purposes of further

transactions or research.

- List Cryptocurrencies Button Added: On the "Entity

Info" menu, a new List Cryptocurrencies button will appear

if the current Selected Entity is one of the two new ETFs

that hold Bitcoin or Ethereum cryptocurrencies. This will

show you whether the ETF has a large unrealized gain or

loss on its cryptocurrency holdings. If it has a large gain

you may receive a capital gains dividend from the ETF in

the near future if the ETF needs to liquidate some of its

holdings in order to pay dividends and pay off any bank

debt it may have temporarily incurred.

- Compatibility:Version 3.0 is file-compatible with

saved game files from all prior versions of Speculator.

Although the 5 new bond and index fund ETFs were not created

in a game you may have started and saved with v. 1.23 or

earlier versions, the 5 new ETFs will automatically be created

and inserted into a game you saved with such a prior version,

when you load the old saved game file. In addition, the two

new cryptocurrency ETFs will automatically be added when

loading any saved game, including games saved under 1.23 or

earlier or under v. 2.0.

Version 2.0 -- Released August 5, 2020 (Major Upgrade):

- Corporation Cash Flow Projections:

This version now includes detailed 3-month cash flow projections

for corporations, which can help you determine when a stock you

are considering investing in (or shorting) is about to run out

of cash and/or borrowing power, and perhaps be forced to sell off

assets when it has burned through all its cash and credit. Or,

it can give you some assurance that a company is sailing along

smoothly, with no near-term liquidity problems. The complex code

that does the calculations is also a diagnostic tool that we use

to give you warnings (pop-ups or in Research Reports on a stock)

when a company is about to experience a serious cash crunch in

the next three months.

- New "Pandemic" Crisis Scenario Has Been Added:

It will only occur in rare situations, but, as in the real world

COVID-19 pandemic, when it does, the effects will be devastating

(unless you happen to own gold or shares in the new triple-leveraged

inverse index ETF, described below)! Like the "Peak Oil" and

"Subprime" crises that can some times occur in the simulation, the

new Pandemic crisis scenario can drag on for years, crushing stock

prices and causing numerous bond defaults and bankruptcies.

- New Leveraged Index ETFs and Bond Funds Added:

Five new ETFs have been added in this major update. Two of the

new ETFs are triple-leveraged funds that rapidly trade the Stock

Index futures, in order to simulate a 3x leveraged position in

the Stock Index at all times. One simulates a 3x "long" (bullish)

position in the Stock Index by buying index futures, while the other

leveraged fund seeks to simulate a 3x "short" (bearish) position

in the index, by shorting appropriate amounts of the Stock Index

futures, with a notional value of 3 times the Stock Index Price.

Both of these funds are EXTREMELY volatile and, as in the

real world, are almost always terrible long-term investments,

because of the constant adjustments they make by buying and

selling enough futures every day to maintain the equivalent

of triple long or short leverage. However, they are excellent

vehicles for short-term trading if you bet right on the trend

of the overall stock market in the simulation, so you can get

rich quick if you're lucky, or get poor immediately if you are

not. Neither of these index funds are "managed" funds, so their

annual management fees are set at the lowest level for ETFs in

Speculator -- 0.2% of net assets per year. The main thing we

can say about these two funds is: "Buyer beware! And hang on

to your hat for a wild ride!"

The other three new funds are a government bond fund that

invests entirely in long-term and/or short-term government bonds,

and two corporate bond funds. One of the corporate bond funds

invests only in "blue-chip" investment-grade corporate bonds,

with credit ratings of BBB up to AAA. The other corporate bond

fund is a "junk bond" fund that invests only in corporate bonds

that are below investment-grade -- from "BB"-rated down to "CC,"

although they will sometimes also buy "C" or "D"-rated bonds

of companies that are profitable and which may be able to

earn enough to improve their credit ratings. While both of the

corporate bond funds will at times buy convertible bonds, the

"junk bond" ETF is more likely to invest in such convertibles.

As with the two index funds, the three bond funds have low

management fees of 0.2% of net assets per year.

The bond funds will occasionally issue bonds when interest rates

are low or borrow from their bankers, to provide some leverage

in both the price of the funds and their yield, if the borrowed

money can generate higher yields from bond investments than the

funds are paying on the amounts borrowed.

Since idle cash in your brokerage account only pays a pitifully

low rate of interest, 1/10th of the Prime Rate in Speculator

(still much better than in the real world, where most brokers

pay zilch on your cash balance, or something like .01 of 1%),

the three bond funds in this new version give you a good

place to park some of your cash at a decent interest rate,

well-diversified, and with minimal risk other than interest

rate risk, since the funds will all tend to rise as interest

rates fall, and vice versa. Thus, you will mainly want to buy

the bond funds when you think interest rates are relatively high,

and may go lower in the near future --- or at least won't go

much higher.

While these 5 new ETFs did not exist in game files you may

have saved with prior versions of Speculator, they will be

added to the data set when you load an old saved game file

into the new version of Speculator, as well as always being

created when you start a new game with this Version 2.0.

- Stock Price Alerts Are Now Available:

Taking a user's suggestion, we have added a feature that

lets you choose to be alerted when a particular stock's

price rises above or falls below a level that you specify.

The alert will remain in effect for a full year of game

play, or until the objective is reached and you are

notified by a pop-up message. A new "Stock Price Alert"

item has been added to the MISC Menu of the "small screen"

version of Speculator, and as a "Settings Menu" item in

the "large screen" version. Simply click on that button

and enter your specified target price for the stock that

is the current "Selected Company," and you will be given a

pop-up notification if the stock reaches the price target

you set, at some time during in the following "year" of

game play. (Otherwise, an alert expires after one year.)

You can do multiple alerts at different prices on the same

stock, and players can have up to a total of 100 price alerts

on file at the same time.

- ETF Leverage Now Restricted: Restrictions

have been imposed on the amount of leverage that an ETF

may take on. An ETF must maintain a net asset value

that is at least 3 imes the amount of its debts (bank loan

and/or bonds issued). If its net asset value falls below

that requirement, it will be required to pay down bank

loans, possibly forcing a sale of some of its investments.

This means that an ETF's line of credit will be smaller

than that of a corporation with the same credit rating, and

that when an ETF issues bonds, the amount will be limited

by the foregoing "300% Rule," which is based on a U.S.

law (the Investment Company Act of 1940) that regulates

the maximum leverage of investment companies, such as ETFs.

- Database Searches of a Single Industry:

Thanks to a user's excellent suggestion, a new item has been

added to the Database Search function, which now allows you

to narrow your search to a single industry. For example, you

might do a search of all banks rated as a "STRONG BUY" by

analysts and which are projected to have an increase of 10%

or more in quarterly earnings for the next quarterly earnings

report.

- Use of Default Browser: Prior versions of

the program were "hard-wired" to launch Internet Explorer when

accessing the Internet for ordering, downloads, update information,

etc. Since Internet Explorer is no longer under development by

Microsoft and most computer users now prefer other browsers, this

version uses whichever browser you have designated as the default

browser for your computer (Google, Edge, Firefox, Safari, etc.).

- New Setting Added To Clear Stock Chart History:

A new item has been added to the Settings drop-down menu on the

main screen of Speculator. In some cases, a very large increase

(or decrease) in a stock's price can make the prior history or

current history fluctuations seem almost like a flat line on the

chart, like when a company's stock trades around 5.00 for several

years and suddenly goes to 1,000 due to some windfall it receives.

In such a case, you may want to erase the stock's prior chart

history and start a new chart. It will take 3 months (or portions

of 3 months) before there is enough new data for that company's

stock chart to become available again. (A stock's chart history

is automatically erased, in most cases, when a company goes

through bankruptcy.)

- Minor Bug Fix:We fixed a minor bug which could occur in

games involving multiple human players. When there is only one

human player, the stock ticker, if running, would continue to run

even after your turn ends, if Speculator becomes the background

program, such as when you open another application, such as your

browser, and Speculator is no longer visible on your computer

screen. That is intended. However, that was still occurring when

there were 2 or more human players, which meant the ticker could

keep running after your turn ended, when it should have stopped

and waited for the next (human) player to begin his or her turn,

which it now does since we have fixed the problem. Thus, now, if

there are 2 or more human players and you cover the W$R screen

with another program while the ticker is running, it will only

run, at most, until your turn has ended, and it is ready for the

next human player to take his or her turn, at the end of a

calendar month.

- Version 2.0 is file-compatible with saved game files from

all prior versions of Speculator. Although the 5 new bond and

index fund ETFs were not created in a game you may have started

and saved with v. 1.23 or earlier versions, the 5 new ETFs will

automatically be created and inserted into a game you saved

with a prior version, when you load the old saved game file.

- Version 1.23 -- Released March 20, 2019 (minor upgrade):

(Free upgrade from Versions 1.20, 1.21, or 1.22)

- Bond Portfolio Listing of Convertibles: The

bond portfolio listings of corporate convertible bonds owned

by players or corporations now indicate, with the abbreviation

"cv." before the coupon rate, that the bonds are convertibles.

As such, you can now tell at a quick glance which bonds in a

bond portfolio have equity features.

- Version 1.23 is a free upgrade for anyone who has bought

Versions 1.20, 1.21 or 1.22. Contact us at MDJENK at AOL (DOTCOM),

to request a download link and include your name and registation

number.

- Version 1.23 is file-compatible with saved game files from

all prior versions of Speculator.

- Version 1.22 -- Released January 1, 2019 (minor upgrade):

- Refinement to Database Searches: The additional

search parameter that was added in v. 1.20, which allowed you to

exclude financial companies from Database Searches, has been

changed to also exclude industrial companies, if less than 20% of

the company's total assets are "business assets" (plant, equipment,

etc.), since those companies are much like a holding company.

Factors like improving industry supply/demand are not that relevant

to a company that has the vast majority of its assets invested in

stocks, options, cash, T-bills, and commodities, rather than in

business (operating) assets.

- Version 1.21 -- Released October 15, 2018 (minor upgrade):

- Changed Timing of Options/Futures Expiration:

Previously, the program made an announcement, on the last day

of the month, if any options or futures contracts of the player

were expiring in the middle of the next month. In some cases,

that was not useful, where there were two or more human players,

if one player's turn was ending at the end of the month, giving

that player little or no time to take any action after seeing

the announcement, such as by closing the position early or

changing the Exercise Options? setting.

This version makes such announcements now at the beginning of the

month in which the options or futures will expire, so the player

now has time (about a half-month of game play time) to take any

needed actions, if he or she doesn't want to simply let the

contract expire on the scheduled expiration date.

- File Compatibility: Version 1.21 is

file-compatible with games saved by any of the earlier

versions of Speculator.

- Version 1.20 -- Released September 1, 2018 (minor uprgrade):

- Additional Search Parameters: The Database

Search functions have been improved, by adding a new search

parameter, which allows you to exclude financial companies

(banks, insurance companies, and holding companies) from

search results. Thus, you can now do searches that are

confined to the 67 categories of industrial companies.

- File Compatibility: Version 1.20 is

file-compatible with games saved by any of the earlier

versions of Speculator.

- Version 1.15 -- Released March 11, 2018 (major uprgrade):

- Currencies Update: Updated the default

currency exchange rates for the 18 non-U.S. currencies

as of March 11, 2018. A player can modify the default

exchange rate at the beginning of a new game, if the

exchange rate for the non-U.S. currency has changed to

a significant degree from the default value.

- Readability: Improved the screen

formatting of various text tables, so that very large

numbers such as 74938459311 will now display as

74,938,459,311, which is much more readable. Also made

changes to allow for much larger numbers than in earlier

versions, as we found some players were able to accumulate

astoundingly large sums of money, nearly crashing the

program.

- Options Pricing Algorithm: Modified the

options pricing algorithm, which was generating values

that we felt were unrealistically high for options that

were very far "out-of-the-money."

- Bankruptcy Changes: Made changes so that

companies that are about to go broke due to losing interest

rate swap positions will now default on the swaps before

being completely wiped out, since the other creditors (bank

lender, bondholders) should have higher priority than the

counterparty on a swap agreement, as senior creditors in

case a company goes under.

- ETF Investment Strategy: Changed the

investment strategy of ETFs (Exchange Traded Funds) to

make them more aggressive by keeping them more fully

invested, instead of maintaining such large cash reserves.

- Stopping Play When Player's Turn Ends:

Made change to stop the stock ticker from running when

the game is in the background, behind the screen from

some other software program, and there are two or more

human players, and one player's turn ends. Otherwise,

the other human player could lose part or all of his/her

turn if time continued to progress, which was not fair.

- File Compatibility: Version 1.15 is

file-compatible with games saved by any of the earlier

versions.

- Version 1.10 -- released October 15th, 2016, with numerous

improvements, as listed below:

- Setting Currency Exchange Rates: If you own the software for a few months

or years, and you like to configure it to play in currencies other than the U.S. dollar,

you will find before long that the currency exchange rates built into the program get to

be out of date, as real world exchange rates can change significantly over time. This

version lets you change the "default" exchange rate by entering a current exchange rate

when you start a new game in a non-U.S. currency.

- Convertible Bond Database Search Improved: In the new version, if you do

a database search, you are given the choice of excluding "busted" convertibles from the

search (those bonds whose conversion price is so far above the stock price, because the

stock price has sunken, that the conversion feature has very little effect on the bond

price, unless the stock makes a very large up move). You can enter a percentage, such

as 20%, for the maximum conversion premium (the bond's price over its current value if

it were converted into stock). In that case, the search would exclude convertible bonds

that trade at more than a 20% premium. This is useful, if you are looking for convertible

bonds to buy that will act pretty much like the underlying stock.

- Limits on Position Size: As a game focused on trading (and realism), the

previous versions already limited a player's ownership of any company to 5% of the stock,

which is the general real world limit, since beyond that, the S.E.C. requires onerous

filing and regulatory requirements that make it difficult to trade in and out of a stock.

However, we did not place any limits on short sales or option positions, so that if you

made enough money, you could theoretically short 5 times or 10 times (or more) as many

shares of a company than actually exist, or buy options on more shares than exist, which

was not realistic.

In order to keep the simulation as realistic as possible, this version imposes a similar

5% limit on short sales and a 10% (of the public stock "float") on call option positions,

and a separate 10% limit on put option positions on a stock.

- Improved Listings of Stock, Bond, and Other Asset Listings: We didn't

expect players who started with $100,000 in this simulation to run their wealth into

the hundreds of billions. We're not sure how they did it, but we were wrong (largely

because of the loopholes noted in the preceding paragraph). In this version, we have

made room in all the various portfolio, balance sheet, and cash flow listings of assets

for much larger numbers. Also, many players have said they would prefer, in portfolio

listings, to see their per share (or per bond) cost, shown next to the current

price per share, rather than their total cost of the position. Also, some players who

got into very large numbers found them hard to decipher when the numbers were not

comma-delimited, such as "12398434849" instead of a more readable "12,398,434,849."

We have made those requested changes in Version 1.10 and expanded the width of the

various tables or listings to accommodate much larger numbers.

- Turnarounds of Sick Companies: In the prior versions, companies

that got in financial trouble almost always continued to fall deeper and deeper

into the hole, often eventually going bankrupt, which made it easy to short such

stocks and wait until the companies eventually went bankrupt and all their stock

was canceled, for a 100% profit on shorts, or bigger profits on put options. In

this version, the odds of "management improvements" that result in an earnings

turnaround have been made somewhat greater, so that shorting such stocks is now

less of a "sure thing."

- Version 1.05 -- Released June 1, 2016 (Shareware changes mainly)

- The shareware version was changed to enable short

selling, options trading, and futures trading features.

However, since (as in the 30-year registered version)

it is necessary to achieve a net worth of $300,000,

$400,000 or $500,000 respectively, to become eligible

for short selling, options or futures trading, it will

be somewhat difficult to achieve those levels in the

3 years of game play allowed in the shareware version

of the program.

A number of minor tweaks were made in both the shareware

and registered versions.

- Version 1.03 -- Released April 15, 2016 (Minor text

wording changes, fixed several typos)

- Version 1.02 -- Released March 23, 2016 (Bug Fix Only)

- Found and fixed bug that could sometimes cause

program to crash during a computer player's turn

during first quarter of a game, if a computer player

was using Strategy #12 of the 12 randomly-assigned

computer player strategies that are assigned at

the start of each game.

- Version 1.01 -- Released: February 1, 2016 (Initial Release)

- This was the first release of Speculator, The Stock

Trading Simulation (initially named Speculator, The

Stock Market Simulation). Please see the extensive

'Help' files and Glossary that are included with the

software (F1 Key for both or click on 'Help Menu' at

top of main screen), for an overview of how the

program works, plus a detailed discussion of each

feature of the program, suggested strategies, how

the program does accounting, computes earnings,

calculates taxes, and much more.

|

TRY THE FREE TRIAL VERSION OF THE SOFTWARE:

-

DOWNLOAD A FREE ("SHAREWARE") VERSION HERE: We believe in "Try before you buy," so you can download

a copy of the free "shareware version" by

CLICKING HERE. The shareware version is generally the same as the Registered Version, except

that games are limited to 3 "years" of play. Also, stock charts are not always available in the

shareware version and it uses fictional company names. The Registered Version allows you to play

games of up to 30 years in length and stock charts are enabled for all stocks, plus the Registered

Version mainly uses real company names for the 1500+ stocks. In addition, the Registered Version

comes with a "Customizer Utility" program that lets you change the names, stock symbols, and

nation of incorporation for any of the companies in the simulation.

|

ORDER THE REGISTERED VERSION HERE:

- ORDER REGISTERED (FULL) VERSION: If you liked what you saw in the "shareware" version,

CLICK HERE

to order the registered version ($21.95 U.S.), and start working your way up the investor

food chain to Short Seller, Options Trader, or Futures Trader status!

- HALF-PRICE FOR REGISTERED PURCHASERS OF WALL STREET RAIDER OR SPECULATOR. The price

for Speculator is reduced to $10.95 for anyone who is a registered purchaser of Wall Street Raider

or Speculator. (E-mail the author at MDJENK {a t} A O L ... [.] ....C O M for the $10.95 ordering

link if you are a registered purchaser of either of our programs.)

|

|